Start by expenses their debts punctually, keeping low stability on your own credit cards, and you can restricting the number of the latest borrowing concerns. Consider using borrowing-building issues, such secure handmade cards, in the event your credit score try scant or low-existent.

Although way to boosting your credit score may require determination, the results normally notably dictate the new regards to your financial, possibly securing you an even more beneficial interest and you will and also make homeownership much more economically possible. A history of prudent borrowing have fun with and uniform loans government means normally incredibly offset the income-relevant challenges faced from the possible property owners.

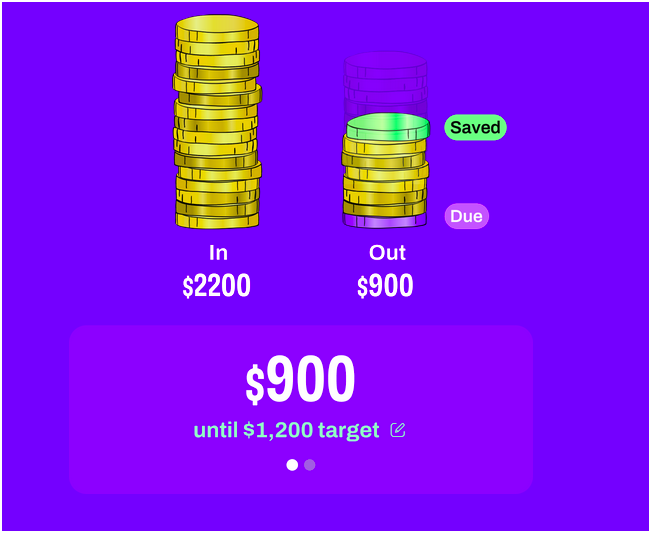

Deciphering Your Deposit

The brand new deposit is perhaps perhaps one of the most difficult facets of shopping for a property for these with a lowered income. In the Canada, minimal downpayment is 5% to own homes costing as much as $five hundred,000. To have property charged between $five-hundred,000 and you may $999,999, you need 5% toward basic $500,000 and you will ten% with the remainder. At least down-payment of 20% is needed for belongings at the otherwise over $1 million, that also exempts the consumer out-of having to shell out home financing financing top.

Low-money consumers tend to not be able to assemble a more impressive downpayment. But not, you can find methods and you will applications specifically made to assist them. Preserving for this initially financing will be triggerred by way of high-interest discounts levels, Tax-Totally free Deals Levels (TFSAs), otherwise due to a subscribed Old-age Offers Plan (RRSP) within the Home Buyers’ Package enabling you to definitely borrow as much as $thirty five,000 income tax-totally free for the basic house downpayment for many who satisfy specific standards.

Service Systems to own Reduced-Income Homebuyers

To possess low-earnings parents, several supportive software are present to really make the downpayment so much more accessible. The above mentioned First-Big date Household Client Extra (FTHBI) is actually a contributed-equity financial on Government away from Canada where bodies also offers 5% or ten% of one’s residence’s price to place on the a down payment.

Which help relieves the strain towards quick deals, towards the caveat that the matter need to be paid off through to new sale of the property or immediately after twenty five years. In addition, various provinces give gives or forgivable financing to simply help which have a beneficial advance payment for lowest-money earners. It’s crucial to look and take advantage of this type of apps, because they can significantly simplicity the latest monetary load and also make the fresh new step on homeownership a tangible fact for reasonable-money Canadians.

Borrowing from the bank the latest down payment to own a home get try a question that numerous lowest-income customers within the Canada may believe. While you are credit to possess a down payment is not traditional or generally demanded as a result of the increased personal debt load they imposes, discover affairs https://elitecashadvance.com/personal-loans-fl/ lower than that it will be possible, such as for example using a fold-down home loan equipment given by particular loan providers, the spot where the down payment is inspired by a line of credit otherwise mortgage.

not, this process requires that the new borrower have solid borrowing in addition to power to create the extra payments of the lent off commission together with home loan alone. You’ll want to remember that the price of credit you will definitely boost the total cost of buying a property. People need very carefully evaluate the terms and conditions and threats ahead of continuing which have borrowing from the bank to cover a downpayment.

Turning to Authorities Software

Navigating through the land from regulators programs having lowest-earnings homebuyers from inside the Canada shows a partnership in order to bolstering affordability and you may entry to. One of the pivotal software is the Federal Houses Strategy, which includes new Sensible Housing Development Funds (AHIF), looking to create reasonable homes and you will help consumers as a consequence of economic contributions and belongings income.

Additionally, the brand new Canada Home loan and you may Housing Organization (CMHC) supplies the Seeds Investment program that can help safety specific will set you back related to developing reasonable casing. Such software functions symbiotically to reduce the brand new barriers to admission towards homeownership for these with minimal financial resources, representing important products inside fostering comprehensive, alternative homes ecosystems.

Tinggalkan Balasan