Which affect borrower qualification can be present in mortgage denial rates, and this increased dos percentage what to 14 % for everybody buy individuals within the 2022. DTI ratio was shown while the top cause for denial.

The speed raise has not affected individuals and you will properties similarly

Cracking out of the decline in purchase mortgages because of the other credit and you will borrower characteristics can display which potential buyers was disproportionately sidelined. Overall, the newest shares away from low-income and highest-combined-loan-to-worthy of (CLTV) consumers each denied by from the twenty-two per cent.

The number of mortgages began to help you light borrowers stopped by the brand new higher share, that is probably informed me by white house are likely to features a preexisting home loan with an interest rate close step 3 percent, definition they will have less incentive to go.

For light borrowers which have lowest incomes, the decrease in originations is just like the complete drop-off, but for consumers of color, the brand new decline try much more obvious. Credit in order to consumers that have reasonable incomes fell cuatro.5 fee items more total credit for Black colored individuals, 5.7 payment facts much more to own Latina individuals, and you will 8.seven commission affairs significantly more to possess Far-eastern borrowers. Which research signifies that borrowers from color that have reduced revenues could be much more responsive to speed changes because they do not feel the riches to gather a larger downpayment so you’re able to decrease the new effects of price expands.

The newest share regarding originations with high CLTV ratios dropped many for white individuals. Even if much more research is needed, you’ll be able you to definitely a heightened show off light individuals-whom, normally, do have more money-been able to proceed to a lower CLTV category having a great huge advance payment, although Black and Hispanic domiciles decrease out of the homebuying business.

Finally, new express of cash consumers therefore the express of people increased throughout the . Considering investigation out-of Real estate professional, the express of money consumers enhanced of thirty two.cuatro per cent to help you thirty-six.one percent during this time period. The newest trader display, provided by CoreLogic, increased away from thirty two.one percent to forty.1 percent. These alter suggest that the speed increase strengthened the brand new cousin to acquire strength of them having higher investment, as they can establish a more impressive deposit or shell out completely into the bucks.

Multiple principles and apps normally raise entry to homeownership within the a high-rates ecosystem

Rising rates of interest has actually pent-up exactly how many mortgages becoming began because of worse affordability, nevertheless the impression is much more intense to own money which have functions on new margins of eligibility. Borrowers who have less overall to place off and lower incomes in addition to have a tendency to depict the lower end out-of homeownership throughout the You.

Rates buydowns, hence assist borrowers secure straight down interest rates if you are paying having points at the start, can offer you to definitely solution to maintain obtainable homeownership through the higher-rates episodes. Buydowns can lessen DTI rates and increase brand new much time-title cost out of home loan debt. Software offering rates buydowns through grants otherwise forgivable financing could possibly get assist borrowers one to would not be in a position to manage homes on the very own.

Getting consumers whom cannot afford buydowns apply for payday loan Fort Carson, growing providers off down payment guidance apps, also special purpose credit apps (SPCPs), may help. SPCPs are running by private loan providers to assist typically disadvantaged groups availability borrowing from the bank. Very SPCPs currently offer downpayment and you may closure cost direction, that will and additionally assist decrease the DTI ratio or over-side will cost you off homebuying.

In place of this type of guidelines or anyone else that can down barriers to possess individuals that have a lot fewer information, the fresh new disproportionate decline away from homebuying during the high-price environment you will definitely worsen current homeownership and you may money gaps.

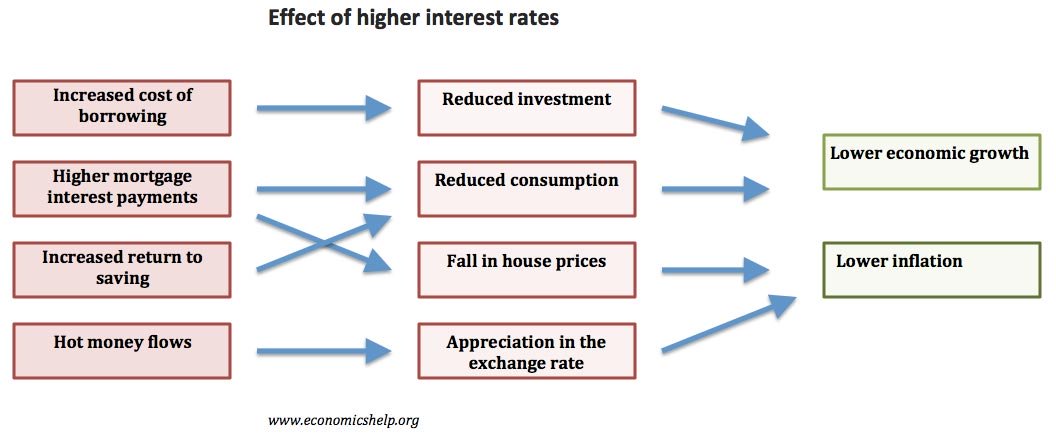

Large cost as well as connect with home loan credit. Given that cost go up, so really does a borrower’s obligations-to-money (DTI) ratio. Financing apps possess DTI thresholds one to determine eligibility. In the event the good borrower’s DTI ratio surpasses 50 %, it is sometimes complicated to obtain a normal mortgage, just in case a good borrower’s DTI proportion is a lot more than 57 percent, the debtor is ineligible to own Federal Construction Management money. Many individuals who would was indeed under the DTI tolerance inside 2021 was indeed pushed over they because of the speed surge (PDF).

Tinggalkan Balasan